The single biggest complaint we hear from finance professionals responsible for Credit, Collections and Disputes Resolution, is that their teams are already too busy to completely cover even the current C&C workload, let alone support ongoing business volume increases without head-count growth.

Quite often a Collector, Dispute Resolver or Credit Analyst will have responsibility for 500 or more customer accounts. On a rolling 30-day cycle, Client-to-Collector ratios above 150 do not typically leave enough time to effectively touch 100% of yourA/R balance-carrying customers. The industry averagesrange between 40% to 60% A/R portfolio coverage on a rolling 30-day basis. Split the difference, this means that as much as 50% of your current balance carrying customers,are not being touched by a C&C team member monthly.This is a shocking revelation, but a C&C reality for far too many companies.

On top of required receivables portfolio/customer touches, the C&C teams are spending countless manual hours researching and resolving potentially hundreds of Disputes, Short-Pays and Deductions in order to prevent revenue shrinkage and unearned-discounts.

Let’s first talk about how C&C Teams organically expand (Figure 1). Agreed, sales growth and DSO/DBT (Days Sales Outstanding/Days Beyond Term) are not linear, but let’s set those to a constant slope for the sake of a simpler model.

Over the last fifteen years and across hundreds of different AR organizations, I have observed the following patterns of growth, what I refer to as Crisis Driven Headcount Management.

For the most part thirty (30) day credit/payment terms, are short-term unsecured loans. Although the terms of Credit are binding, the reality of customers paying on time does not always work-out as planned. Thus the birth of Collections, which for a fledgling business, starts with one C&C FTE (full time equivalent employee). C&C FTE’s are responsible for executing credit, collections and dispute FTEE’s (FTE Events). C&C FTEE’s as basically any task executed within the process of on-boarding a new customer, converting a customer invoice to cash or adjudicating a payment dispute.

As revenue grows and the company’s exposure to accounts receivables increases, the size of the C&C team and number of FTEE’s increases to protect what is typically 60% of their company’s available working capital. But the C&C team expansion does not occur smoothly; it “reacts”after the DSO/DBT reaches an unacceptable financial point of risk tolerance.When the Actual DSO exceeds the Target DSO tolerance, the “reaction” comes in the form of hiring another C&C team member or two.

Once hired and trained, the delinquent accounts receive more attention and the DSO/DBT responds favorably and begins to drop below target DSO to acceptable levels…and then this repeats. I like to refer to this as the C&C Wash Rinse and Repeat cycle.

So how do companies escape this traditional react-driven C&C growth cycle? What effect does this fits-and-starts “crisis response”cycle have on how your company’s working capital and what do your key stakeholders think about these practices, particularly related to your C&C team and the productivity of their FTEE’s?

This “Crisis-Driven” environment is pervasive across most C&C departments. In response to the latest crisis deux jour, management will allocate the minimum amount of additional resources and no more . It typically starts with Temps who never seem to leave. This reactive approach pervades the culture of C&C departments. I have yet to meet an OTC manager who is not excessively busy. Complicating this further is the lack of access to the necessary IT or Consulting resources who could provide assist in the streamlining of the processes.

In an April,2016 Ernst & Young Financial Accounting Advisory article by Ev Bangemann, Peter Krzyanowski and Myles Corson titled “Improving Your Finance Function Effectiveness”, they talk about creating centers of excellence(CoE’s)and describe the changing business landscape and finance operations expectations. “Finance functions in many companies are evolving to become more efficient, effective and a better partner to the business. At the same time, stakeholders’ expectations of a modern finance organization are increasing.”

They go on to point out that “…key challenges companies are facing is realizing a functioning operating model for each area within the finance and accounting function, while ensuring process quality and employee acceptance.”The trick here, is having processes and a finance information system which helps you create and maintain an effective “operating model”,which your C&C teams can grow with and be more productive through.

This might sound obvious, but everyone reading this article has used many different ERP (enterprise requirements planning) systems over their careers which actually hindered C&C effectiveness. Whether your ERP is SAP, Oracle, Microsoft, PeopleSoft, JDE, Infor or some form of home-grown legacy system(e.g. IBM AS400 hardware running RPG software on a DBII database) you know first-hand that most ERP systems do not deliver to expectations.

The single biggest challenge these ERP systems face is being really good at delivering best-of-breed core competencies to every operating function within your company. This is the classic “jack of all trades, master of none” scenario and it is especially true when it comes to the critical requirements of a C&C team, who is responsible for so much of a company’s available working capital.The stakes are very high and as the weighted cost of capital (WCC) continues to climb, the C&C team will receive much more attention from executive management.

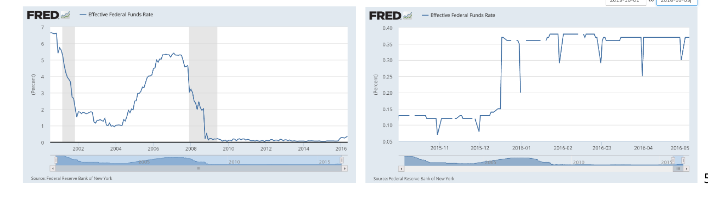

In January of 2016 the CBO (Congressional Budget Office) released “THE BUDGET AND ECONOMIC OUTLOOK: 2016 TO 2026”. In this report they tell us theDecember 2015 interest rate hike and projected continued increases in the effective federal funds rate (EFFR), “…(will) rise from their currently low levels. The Federal Reserve had held the target range for the federal funds rate (its primary policy rate) at zero to 0.25 percent since late 2008, but in December 2015, it raised the range to 0.25 percent to 0.5 percent. CBO projects that the federal funds rate will rise to 1.2 percent in the fourth quarter of 2016 and to 2.2 percent in the fourth quarter of 2017 before settling at 3.5 percent in the second quarter of 2019.”

As of May 5th, 2016 the EFFR was 0.37%. For most companies the weighted cost of capital (WCC) today is around 4-8% with many companies already experiencing double digit WCC rates.

The CBO projects “Interest rates on federal borrowing are also expected to rise steadily over the next few years, as the economy improves and the federal funds rate rises. CBO projects that the interest rate on 3-month Treasury bills will steadily rise from 0.1 percent in the fourth quarter of 2015 and settle at 3.2 percent by the middle of 2019. CBO also projects that the interest rate on 10-year Treasury notes will rise from 2.3 percent in the fourth quarter of 2015 to 4.1 percent by the second half of 2019.”

So where do you need to focus your C&C team’s efforts to make the most significant impact on available working capital and how do you address this react-driven C&C growth cycle? Let’s take a look at what we need to change in order to realize better financial outcomes and build a new paradigm for C&C operational execution.

Some of the key components Matt and I covered in the CRF June Webinar, were these six core-competencies for the C&C team to improve operational performance:

- Applying Six Sigma DMAIC Methodology to Order-to-Cash (DMAIC OTC)

- Strategic Collections Management (SCM)

- Methods for Dispute Resolution Cycle-Time Compression (DRC)

- Achieving 100% Portfolio Coverage-Each 30-Day Cycle

Let’s start by looking at applying Six Sigma DMAIC Methodology to Order-to-Cash (DMAIC OTC). If your company has already embarked on applyingSix Sigma or Lean Sigma Processes to finance operations, you are among the growing number of enterprises striving to improve your order to cash lifecycles, which includes everything from new customer onboarding to automating internal collaboration for dispute adjudication.

Everybody is already working on C&C process improvement. You must, because accelerating invoice to cash conversions, is at the heart of avoiding having to sell your productive investments generating return on invested capital(ROIC)or borrow against your credit lines (WCC) to have enough cash to run your business.

Back in the early 1980’s, Motorola developed the Six Sigma business management methodology to improve manufacturing quality, reduce defects and systematically eliminate chronic causes of rework. Basically a six-sigma process says that 99.99966% of the time, you get it “first time right.”, free of errors or defects. Comparatively in a ‘one-sigma’ process, only 31% of the production is free from errors. At the same time Motorola was applying this process improvement methodology to manufacturing, they also started using these principles in F&A, including C&C –with tremendous results.

As E&Y pointed out, finance executives and company stakeholders are making order-to-cash (OTC) performance a top priority. In many cases OTC and C&C key metrics or KPI’s (key performance Indicators), are tied to valuations, lending rates and executive bonuses. With profit margins under more global pressure each year, departments being told “zero head-count growth” and interest rates on the rise…you need to create processes which are scalable, replicable and produce more predictable financial outcomes.This is where Six-Sigma, Lean-Sigma and Quality Programs come into the picture.

Applying Six Sigma DMAIC Methodology to Order-to-Cash (DMAIC OTC)

In order to effect permanent and positive impacts on working capital it is critical to migrate the A/R culture from a reactive to proactive/preventive approach. This is why using Lean-Six Sigma is critical to breaking the crisis-react-wash-rinse-repeat cycle.

There are five basic elements to applying DMAIC(Define, Measure, Analyze, Improve and Control) process to an order-to-cash (OTC) or C&C improvement project:

- Define an OTC or C&C process improvement initiative, which will impact working capital, inter-departmental collaboration or customer satisfaction. Then establish a team of constituents involved in the OTC or C&C process which you want to improve (e.g. #3 Methods for Dispute Resolution Cycle-Time Compression (DRC).This will require Collections,DisputeManagement, Credit, Sales, Customer Service,Accounting, Contracts, Shipping and perhaps even Marketing). Having key constituent departments involved in ‘Defining” a customer facing OTC or C&C problem is a must if you hope to produce better financial outcomes or increase customer satisfaction in doing business with your company.

- Where do things stand today, and how will you Measure the extent of the problem? How will you know if your changes are making a difference? Having knowledge of your Current-State and then quantifying the impact of solving this problem concerning key performance index metrics determines what financial outcomes you are desiring for short, medium and long-term goals. You will want to track KPI improvements. You will be surprised just how much you can actually accomplish.

- Analyze the available data and current-state of your finance processes. What can you tell that is working; what is not working? What are the current financial outcomes you are able to produce and what is the delta between current and best-possible? The cross functional team should be looking for the root causes of chronic issues, weather upstream (prior to hitting the OTC team),or downstream within the finance department and its current processes or systems. Quantifying the deltas between current-state and best-possible, the improvement-gap, will give you an idea of the possible.

- Improve the processes and systems. There might be a great deal of improvement possible simply by changing your current manual methods, intra and inter departmentally. At some point you will hit diminishing marginal returns(DMR),where 1 unit of manual process effort no longer delivers1 (or more) units of production improvement. If you already run a tight OTC ship, you might reach DMR very quickly. If you run multiple OTC operations globally, possibly in disparate financial shared service centers (FSSC’s) , there is usually a fair amount of improvement possible, simply because it is very difficult to get ‘everybody on the same page’ globally if everybody is looking at slightly different information, coming from slightly (or very) different information systems. At the point of DMR, you will need to move beyond manual methods and start using scalable automation solutions to give you sustainable and replicable financial outcomes for all geographic operations.

- The last element in DMAC OTC is Control. Quality initiatives are not short term projects or campaigns that come and go.You will achieve short term benefits, but establishing a quality process is something that needs to be maintained and every time you hire a new resource, they need to understand their part in supporting it. Your OTC of C&C operational, financial and customer satisfaction outcomes, are all tied together in processes which are designed to look for ways to continually improve. Controlling these processes with reporting analytics and graphics which make it very easy to see when things are trending in the wrong direction are critical to long-term success. Automation that makes this possible is key and standardized finance processes which your department (versus IT or the vendor)can easily adapt to change and replicate across other operating units will help you realize global Working Capital impact.

Strategic Collections Management (SCM)

In an April 2016 E&Y Financial Accounting Advisory Services article by Pankaj Chadha, Myles Corson, Vish Dhingra, and Ken Akaishi, titled “Designing a finance function to meet tomorrow’s challenges” the authors state that “The prevailing view is that the finance function has been in ‘react mode’ and is now challenged to improve and add value.”

I agree with their argument: “When identifying value-creation opportunities, finance can best support the business by providing the right information to their stakeholders at the right time and being closely involved in strategic discussions. To be efficient and effective, the finance function should have an appropriate operating framework and supporting policies, procedures and processes. Lastly, when managing business performance, finance leaders should be active business partners providing advice and support to all levels in the business —from strategic to operational.

“…providing advice and support at all levels in the business…” This is perfect and it means we need to be thinking strategically and holistically within the OTC and C&C functions to help the business thrive. It also tellsC&C practitioners that your role and how it is perceived by management is evolving, you are finally getting the attention you deserve.

Strategic Collections Management (SCM)is much more than applying fancy algorithms against receivables aging data to tell your collectors who they should be calling today. Especially if this ‘advice’ tells your C&C team member that they have to connect with 300 people today…when they know they only have time to connect with 52. When faced with these typical and overwhelming system generated task-lists, Collectors simply ignore the ‘advice’ and go back to tried-n-true “oldest-largest-balance-collections” and start calling large dollar invoice “volunteers”,who for the past twelve (12) years have paid 17 days past-due, like clockwork.

SCM is about setting priorities and evaluating how that set of specific tasks will impact working capital. The first thing a collector should focus on in the morning is following up on dollars that were committed to your company’s operations, which were not delivered by your customers. These “broken promises to pay” are quite often manually maintained in notes fields in the ERP system or Microsoft Outlook Calendar reminders. But each and every one of these open reminders, needs to be followed up to determine the disposition of the obligation. Statistically 85%+ of the time, they are paid. So 100% of the effort to: See the reminder; Open the Account; Check if the Invoice was paid…is wasted, for all paid invoices.

This single example on Promises to pay, of managing-to-the-rule, versus managing-to-the-exception is replicated across all Collectors, all Accounts and all invoices with promise commitments –daily. The best practice is having your system keep track of the Promise;Automatically checking to see if an invoice was paid; and Automatically clearing away the Reminder when full payment is received. If partial payment is received, the system should generate a Dispute Case and help you Assign each case to a responsible party in your company to help you resolve.

Other SCM Best Practices fall into many categories like: The segregation of “Clean” versus “Dirty” Accounts Receivable to optimize resource effectivity, execute one-call resolutions, minimize collections pre-call preparation time, improving reporting and streamlines OTC sub-process; Creating a robust Client Portal for Self Service (e.g. Reprint Invoices, generate statements, make disputes, make ACH payments); Automatic generation of work queues by Customer Segment, by TreatmentMethodology, by Risk Class and Specialization(e.g. Having Collectors who specialize on complex contract collections); Implementing a single OTC productivity platform for managing all aspects of C&C so you are not constantly switching between systems to see the whole picture (e.g. Eliminating the Alt+Tab daily routine); and Having full visibility of the parent/child hierarchical relationship globally for full exposure visibility.

Methods for Dispute Resolution Cycle-Time Compression (DRC)

Collectors do not create disputes or the reasons customers pay short or fail to pay…but Collectors are responsible for resolving the dispute sand they need a DRC methodology to do it more effectively.

The challenge is, more than 85% of the time, the Collector needs to reach out to a Sales Person, an Accounting Person, a Shipping Person, a Customer Service Person,…etc., and they are doing most of these resolution outreaches manually, by phone calls and emails.

Phone calls and emails are not scalable, not replicable, not consistent, and not guaranteed to get a reply. Manual processes in general are extremely difficult to track on-going progress through, and typically have no SLA’s or Escalation path except the ones you execute manually. You cannot easily report manual dispute resolution cycles or determine the full-extent of the dispute issues, across your receivables portfolio(especially in parent/child hierarchies)…let alone help eliminate the causes, up-stream, to improve the overall dispute process.

Plus, in order to proactively eliminate chronic recurring dispute issues, you must be able to quantify the frequency and dollar extent of the dispute reason code; where geographically the chronic disputes are occurring; and When in the order to cash lifecycle the disputes are occurring–are there any systemic causes.

A good DRC system will give you the ability to identify negative trends which could impact Collections. Ideally you should be able to: 1) Pre-Identify pending Short-Pays in your major accounts A/P Portals and automatically identify current short-pays in the EDI payment feeds (most companies are not doing this today), and of-course when the Collector is on the phone with a customer and then create a Dispute Case number which you can assign, set SLA’s for and escalate if you do receive a reply; 2) Enable you to dispute 100% of the deductions you are receiving, especially when they come in large batches and low dollar amounts across 10’s, 100’s, or possibly 1000’s of delivery locations for a single order fulfillment.

Achieving 100% Portfolio Coverage – Each 30-Day Cycle

The last item that I will cover in this article is receivables portfolio coverage and how important it is to achieve 100% portfolio coverage(touching every customer with an outstanding balance) every 30 day cycle. As mentioned at the beginning, C&C team members might be responsible for 500 or more customer accounts. Because of this, on average most C&C team members can only effectively engage with 50% of their balance carrying customers.

Most companies have some number of large customers, who generate 70%-80% of the company’s revenue. Typically, this is somewhere around 20% of the entire (or active) customer base. Commonly the High-Dollar customers generate smaller invoice volume, than all of the rest of the active customer combined, let’s call this group the High-Value/Low-Volume customers.

That leaves the “rest”of your customer base, who represent 20%-30% of the company’s revenue. Let’s refer to them as the High-Volume/Low-Value clients.Clearly when it comes to Segmentation Strategy, Treatment Strategy and Collections Methodology –these two distinct groups need to be handled very differently. Some general observations which you can validate with your customers:

- More and more High-Dollar customers are demanding that suppliers come into their A/P Portals to reconcile payments and adjudicate disputes. This is especially true with customers like Walmart, Kroger, Costco, Menards, Amazon, Home-Depot and Lowes.

- High-Dollar customers, like the ones above, will (almost) never go to your Customer Self Service Portal to do anything.

- High-Volume/Low-Value customers will absolutely come to your Customer Self-Service Service Portal. In fact, the Millennials (people born from 1980 to 2000), and a rapidly growing number of A/P and Purchasing personnel, don’t want a phone call from a Collector. They prefer going to a Portal to see their outstanding and pending invoices (Sales Orders), identify invoice disputes, request a credit increase or make an ACH payment.

So this means you need a way to address High-Dollar customer’s A/P Portals and EDI Payments with automation.At the same time you need to create self-actuating HTML email reminders, which direct Low-Dollar Customers to a robust Self-Service Portal, so that they can effectively do anything they could do on the phone, with a Collector/Credit Manager/DisputeResolver/Cash Applier.

Doing both of these in parallel is the only way you will be able to realize 100% A/R Portfolio coverage on a rolling 30-day cycle and maintain zero head-count growth as your business grows.

Lastly, and most importantly, the culture of the AR Department is one where the work loads vary from crisis to just maximum. Meaning, there is little time, or even less IT or consulting resources, to proactively improve processes and technology. It is essential that tools delivered to the AR team are highly configurable without the need for either IT or Consultants. This is why Excel is still the number one tool used today in AR even in shops that have existing “automation” software. If it takes time, money and or resources, it just does not get done in today’s AR departments. Autonomy from IT and Consultants is a key success metric to support a proactive, Lean –Six Sigma approach.

Related Posts

Crisis Driven Collections Headcount Management – Moving OTC from Reactive to Proactive

Article Crisis Driven Collections Headcount Management – Moving OTC from...

Cforia is now part of HighRadius

HighRadius Announces Cforia Acquisition Combination of...

Creating Single View of Cash Across Global Finance Operations

Article Creating Single View of Cash Across Global Finance...